Trump’s TikTok deal won’t cut off China’s algorithm, but it could give a lot of people a big payout

The first thing to understand about the TikTok deal is that it’s not actually a deal—at least not in any official capacity yet. Trump’s executive order Thursday simply delays the Chinese social media app from being banned in the U.S. (as required by a law passed in the spring of 2024) for another 120 days, while the various parties seek to finalize an agreement.

So there’s a lot we don’t know about the agreement, and there’s a lot that could change.

But if you listen closely to everything that was said during Trump’s signing ceremony, and if you piece together the official White House statements as well as various press reports about the deal, a couple things become clear:

- The China-built algorithm at the heart of the U.S. national security concerns will continue to serve content to Americans, albeit with some kind of oversight and “retraining.”

- The deal creates an opportunity for a lot of the people involved to make money.

Whether that makes the deal a good deal or a bad deal probably depends on your views on everything from geopolitics to Wall Street financial practices, but if nothing else, it’s an unusual deal that’s quite different from what many were expecting.

Made in the USA?

Let’s start with the American version of the TikTok app that will be spawned as a result of the deal.

According to the White House, the portion of the TikTok service that currently serves U.S. residents will be divested from Chinese parent company ByteDance. A new, separate “American TikTok” will be created and placed under the control of a joint venture that’s “majority-owned and controlled by United States persons.”

All user data for this app will be stored in U.S. data centers operated by Oracle (a practice that actually began in 2022 in response to U.S. concerns), thus ensuring the privacy and security of Americans’ data.

The joint venture will also be responsible for overseeing the algorithm that picks which video clips appear in users’ feeds. But it looks as if the actual algorithm powering American TikTok will continue to be the one developed by ByteDance—the very algorithm that lawmakers have said could not be trusted because of ByteDance’s ties to China, a “foreign adversary.”

In its official “Fact Sheet” about the executive order, the White House said “the divestiture puts the operation of the algorithm, code, and content moderation decisions under the control of the new joint venture.” The order calls for “all recommendation models, including algorithms, that use U.S. user data to be retrained and monitored by America’s trusted security partners.”

What it does not explicitly say is that American TikTok will create its own new algorithm from scratch.

The idea seems to be that any danger posed by a China-made algorithm can be eliminated by putting a U.S. filter on top of it. How this would work in practice remains to be seen. Will the U.S. have complete access and visibility into the algorithm, or will it essentially be trying to outsmart a black box? And could the U.S. filter be so strong that it kills the magic, resulting in a bland, adulterated American TikTok that no self-respecting teen will actually want to use?

A licensing deal and a lot of upside

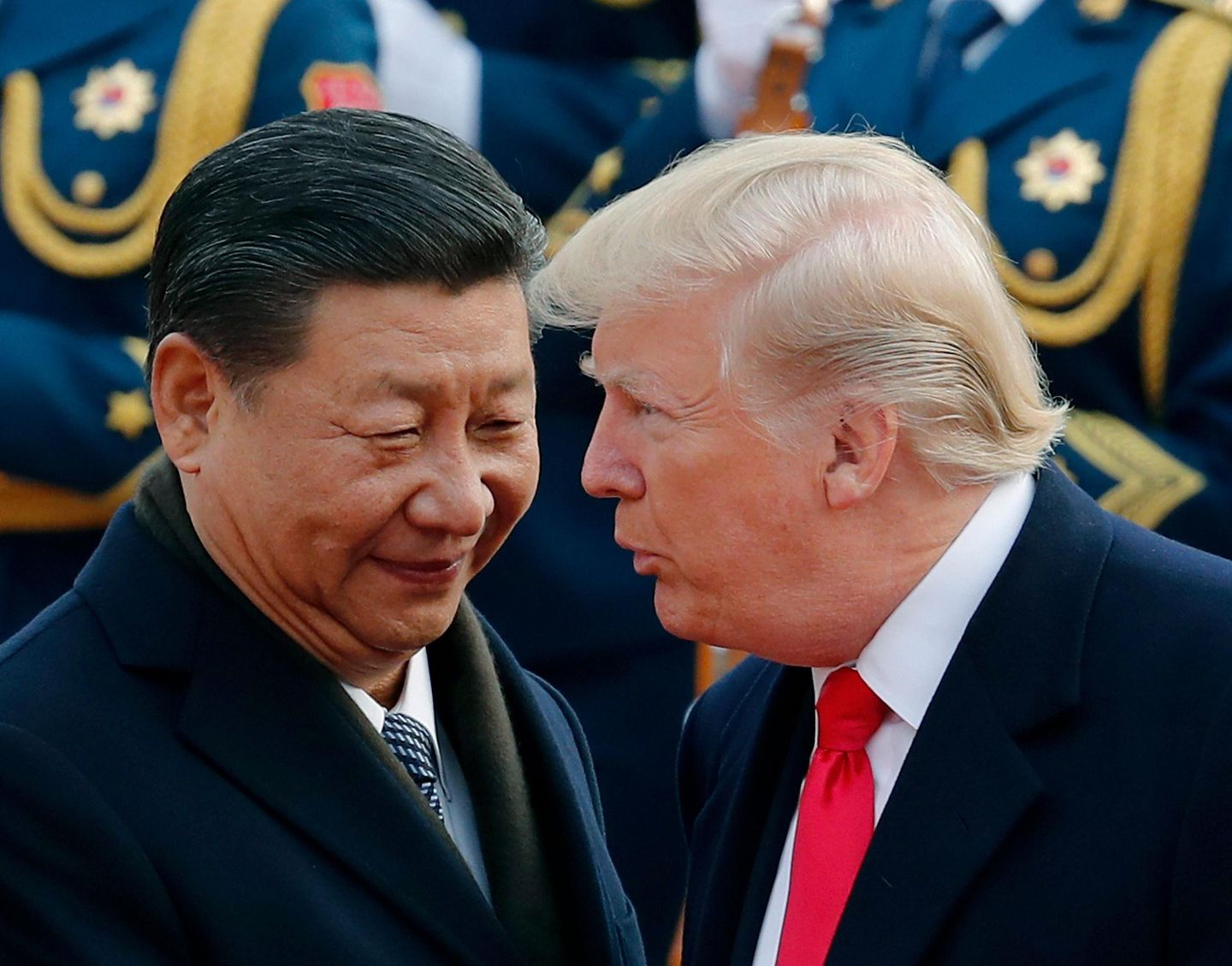

According to a Bloomberg report citing anonymous sources, the JV will license the algorithm from ByteDance, paying the company 20% of revenue and as much as 50% of profits. In a way, it’s an elegant solution to a tricky problem: ByteDance continues to own the algorithm and a 20% equity stake in an asset that bears its brand in the U.S., and it gets an ongoing financial incentive in the venture—all of which lends the endeavor a friendly air of collaboration rather than appropriation.

The ongoing licensing fee also means the U.S. investors can acquire the asset with a very low down-payment. Vice President JD Vance said Thursday that the deal was valued at $14 billion — leagues below many analyst estimates, which pegged the value somewhere between $35 billion and $50 billion. The only way that price would make sense for ByteDance is with a licensing fee that sends future, high-margin revenue its way.

Axios reported that Silver Lake, Oracle, and MGX (an Abu Dhabi-based fund) will have a combined 45% stake in the new joint venture, while a 5% slice is being reserved for a new group of investors that’s “still in flux.” That 5% group might include Rupert Murdoch and Michael Dell, names that Trump cited during Thursday’s signing ceremony. And one can imagine plenty of other friends of the Trump administration eager to get admitted into that 5% club, given the low price of admission.

Now, let’s imagine that at some point after the deal is done, the new owners of American TikTok decide to float shares to the public in an IPO. Barring some unexpected disaster, the offering would almost certainly value American TikTok at a level above $14 billion (for comparison, Snap has a $14 billion market cap even though Snap’s U.S. user base is considerably smaller. Whether the investors sell in the IPO, or after the shares are trading, there’s a lot of potential upside.

The deal might even open a path for ByteDance to accomplish its long-awaited IPO dreams. The company shelved plans to list shares in Hong Kong in 2021 amid issues with Chinese regulators over data security, and the uncertainty over TikTok’s fate in the U.S. has put damper on any public market listing since then. Free of the U.S. headache, ByteDance will have a much more attractive case to make to the public markets—including that nice licensing income.

There’s a lot of potential winners in this deal. Whether the American public is one of them remains to be seen.

This story was originally featured on Fortune.com

:quality(85):upscale()/2023/09/18/918/n/1922398/a1136b676508baddc752f5.20098216_.jpg)

:quality(85):upscale()/2025/10/09/670/n/1922283/00b944c868e7cf4f7b79b3.95741067_.jpg)

:quality(85):upscale()/2025/09/09/891/n/1922283/7222624268c08ccba1c9a3.01436482_.png)

:quality(85):upscale()/2023/10/03/668/n/1922283/1f15c8a9651c2d209e5eb5.32783075_.jpg)

:quality(85):upscale()/2025/02/03/788/n/1922283/010b439467a1031f886f32.95387981_.jpg)